A health insurance premium is the amount you pay monthly for coverage, while a deductible is the out-of-pocket cost you must pay before insurance kicks in. Premiums ensure continuous coverage, while deductibles determine initial costs before benefits apply.

Understanding these two aspects is crucial for making informed decisions about healthcare coverage. Premiums vary based on coverage level and insurer, impacting monthly expenses, while deductibles influence initial out-of-pocket costs before insurance coverage starts. Depending on your health needs and financial situation, choosing between a higher premium with a lower deductible or a lower premium with a higher deductible can significantly impact your healthcare expenses.

By grasping the difference between health insurance deductibles and premiums, individuals can make informed choices to ensure adequate coverage while managing costs effectively.

Credit: www.cnbc.com

Introduction To Health Insurance Costs

Understanding health insurance costs is crucial for making informed decisions about your coverage. Two key components that directly impact your overall health insurance expenses are deductibles and premiums. Both play a significant role in determining how much you pay for your healthcare and the level of financial protection your policy offers.

Key components: Deductibles and PremiumsKey Components: Deductibles And Premiums

When it comes to health insurance, it’s important to grasp the differences between deductibles and premiums. These two elements directly affect your out-of-pocket expenses and the overall cost of your health coverage.

Deductibles

Deductibles refer to the amount you must pay for covered healthcare services before your insurance plan starts sharing the costs. In essence, it’s the money you pay out of pocket for medical expenses before your insurance kicks in to help cover the remaining costs.

- Deductibles can vary widely based on the type of plan you choose.

- Higher deductibles typically result in lower monthly premiums.

- Lower deductibles often lead to higher monthly premiums.

Premiums

Premiums, on the other hand, represent the amount you pay to your insurance company for coverage. This payment is typically made on a monthly basis, and it’s essential for maintaining your health insurance policy.

- Premiums are not directly linked to your out-of-pocket expenses for healthcare services.

- The higher the premium, the lower the deductible in many cases.

- Lower premiums often mean higher deductibles, and vice versa.

What Is A Premium?

When it comes to health insurance, a premium is the amount of money you pay to your insurance company each month for coverage. This payment is required even if you don’t use any healthcare services during that month. In essence, it’s like paying rent for your insurance coverage.

Role Of Premiums In Health Insurance

The role of premiums in health insurance is to ensure that you have continuous coverage for healthcare services. Without paying a premium, you would not have access to the benefits of your health insurance policy. The premium amount is based on several factors, including your age, location, lifestyle, and health history. It’s important to note that premiums are not the only cost associated with health insurance.

Factors Influencing Premium Rates

There are several factors that can influence the premium rates of health insurance policies. These include:

- Age

- Location

- Health status

- Smoking status

- Pre-existing conditions

- Choice of plan

- Deductible amount

It’s important to note that premiums and deductibles are often inversely related. This means that if you choose a plan with a lower deductible, your monthly premium will likely be higher. On the other hand, if you choose a plan with a higher deductible, your monthly premium will likely be lower.

In conclusion, understanding the role of premiums in health insurance and the factors that influence premium rates can help you make an informed decision when choosing a health insurance plan. It’s important to choose a plan that fits your individual needs and budget, while also providing adequate coverage for your healthcare needs.

Understanding Deductibles

Function Of Deductibles

A deductible is the amount of money that an individual must pay out of their own pocket before their health insurance plan starts covering the costs. It serves as a form of cost-sharing between the individual and the insurance provider. The purpose of a deductible is to help control the overall cost of insurance by requiring the insured person to bear some of the initial expenses.

Impact On Health Care Accessibility

The presence of a deductible can influence a person’s access to healthcare services. For individuals with high deductibles, the financial barrier may deter them from seeking necessary medical care, resulting in delayed treatments or avoidance of preventive services. On the other hand, low deductibles can facilitate easier access to healthcare services, as the out-of-pocket costs are minimized.

Comparing Premiums And Deductibles

When choosing a health insurance plan, understanding the difference between premiums and deductibles is crucial. Premiums are the fixed amount you pay monthly for your insurance coverage, while deductibles are the out-of-pocket costs you must pay before your insurance kicks in. Let’s delve into the nuances of comparing premiums and deductibles to help you make an informed decision.

Trade-offs Between Lower Premiums And Higher Deductibles

- Monthly cost is less

- Higher out-of-pocket costs

- Suitable for those who rarely visit the doctor

- Lower monthly cost

- Higher cost when receiving medical care

- Ideal for individuals with regular medical needs

Choosing The Right Balance

When deciding between premiums and deductibles, it’s essential to strike a balance that aligns with your healthcare needs and budget. Consider the following:

- Assess your health condition and anticipated medical expenses

- Calculate potential total costs under different scenarios

- Factor in any prescription medications or ongoing treatments

- Compare premiums and deductibles across various plans

Financial Implications Of Deductibles And Premiums

Understanding the financial implications of health insurance deductibles and premiums is crucial for making informed decisions about healthcare coverage. By delving into the differences between deductibles and premiums, individuals can gain clarity on how these factors impact their budgeting and long-term healthcare costs.

Budgeting For Health Care Expenses

When considering health insurance options, it’s essential to factor in the potential financial strain of deductibles and premiums on your budget. Higher premiums generally result in lower out-of-pocket costs when you receive medical care, whereas higher deductibles typically lead to lower monthly premiums but higher out-of-pocket costs when medical services are utilized.

- Higher premiums = lower out-of-pocket costs

- Higher deductibles = lower monthly premiums, but higher out-of-pocket costs

Long-term Cost Analysis

Looking beyond immediate budget considerations, it’s important to analyze the long-term cost implications of deductibles and premiums. Lower premiums can provide cost savings for those who require regular medical attention or have chronic conditions. In contrast, higher deductibles may result in greater overall costs if substantial medical care is needed.

Case Scenarios

The difference between health insurance deductible and premium is that the deductible is the amount you pay for covered health care services before your insurance plan starts to pay, while the premium is the amount you pay for your insurance coverage every month.

Choosing a lower deductible means higher monthly premiums, and vice versa.

Low Premium, High Deductible Plan

A low premium, high deductible plan offers lower monthly costs but higher out-of-pocket expenses when you need medical care.

High Premium, Low Deductible Plan

A high premium, low deductible plan means higher monthly costs but lower out-of-pocket expenses when you require medical services.

Strategies To Optimize Health Insurance Costs

To optimize health insurance costs, understanding the difference between health insurance deductible and premium is crucial. A lower deductible plan with higher monthly premium is ideal for frequent medical needs or possible emergencies, while a higher premium often correlates with a lower deductible amount.

These factors directly impact overall healthcare expenses.

Assessing Needs And Risks

Before choosing a health insurance plan, it is important to assess your personal needs and risks. This means taking into account your medical history, current health status, and any potential health concerns. By doing so, you can better determine what type of plan will provide you with the most comprehensive coverage while still being affordable.Evaluating Health Insurance Plans

Once you have assessed your needs and risks, the next step is to evaluate different health insurance plans. This involves comparing deductibles, premiums, and other out-of-pocket expenses to find a plan that best fits your budget and healthcare needs. One strategy to optimize health insurance costs is to choose a higher deductible plan with a lower premium. While this may mean paying more out-of-pocket for medical expenses, it can result in significant savings over time if you do not require frequent medical attention. Another strategy is to consider a Health Savings Account (HSA) plan. This type of plan allows you to save pre-tax dollars for medical expenses and can be used in conjunction with a high-deductible health plan. By contributing to an HSA, you can lower your taxable income and save money on healthcare expenses. In conclusion, optimizing health insurance costs involves assessing your needs and risks, evaluating different plans, and considering strategies such as choosing a higher deductible plan or utilizing an HSA. By taking the time to carefully evaluate your options and choose a plan that best fits your needs and budget, you can ensure that you have the coverage you need while still keeping your healthcare costs manageable.:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

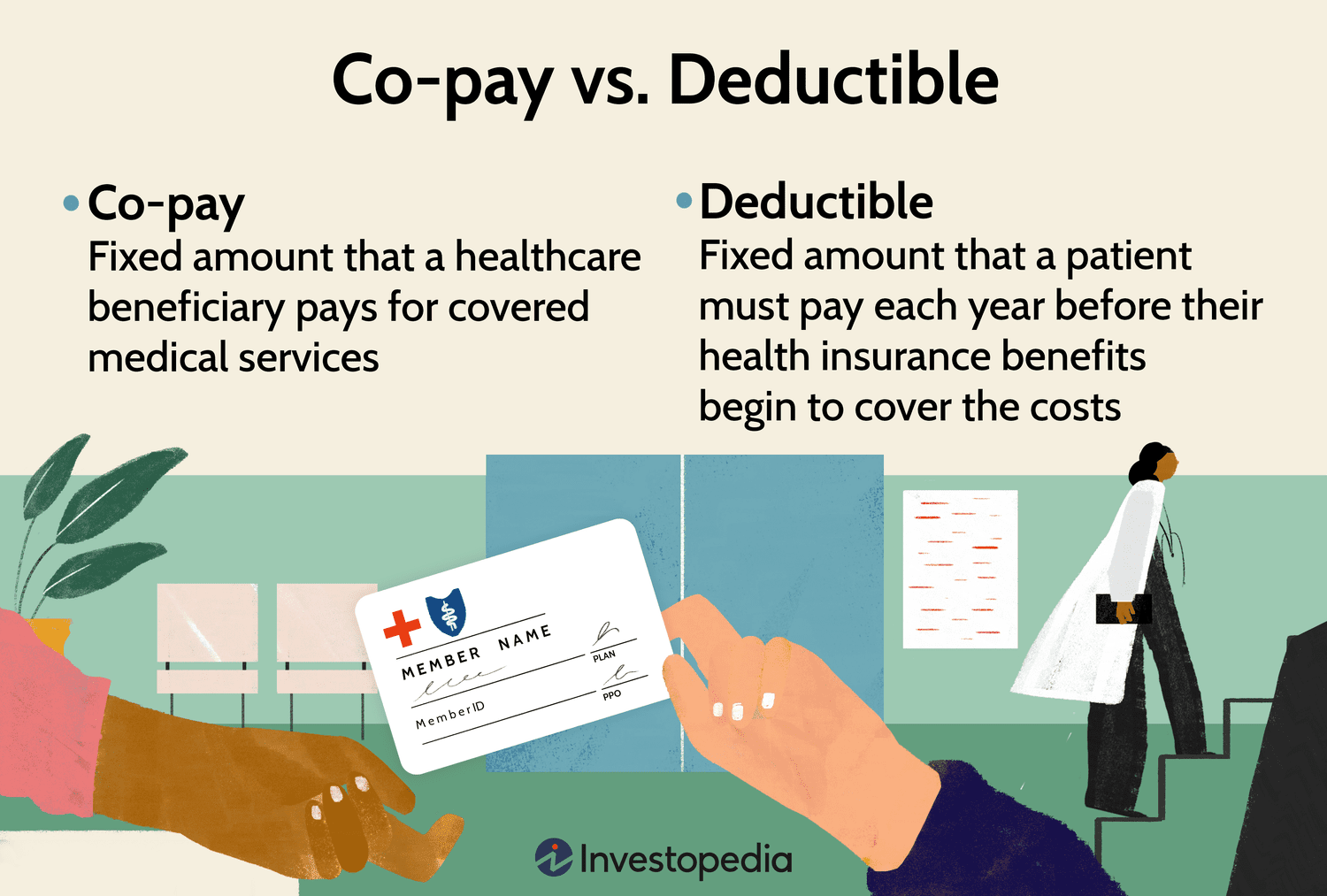

Credit: www.investopedia.com

Credit: www.internationalinsurance.com

Frequently Asked Questions

Is It Better To Have A Lower Deductible Or Premium?

It’s better to have a lower deductible if you need frequent medical care. Although the monthly premium is higher, the deductible is more affordable.

Is The Higher The Premium The Higher The Deductible?

Higher premiums usually come with lower deductibles, and lower premiums typically mean higher deductibles.

What Is The Point Of Health Insurance If You Have A Deductible?

Health insurance with a deductible requires you to pay a set amount before coverage kicks in. It helps manage costs and encourages careful healthcare spending.

Is Your Premium Higher The Lower Your Deductible?

A lower deductible results in higher premiums, while a higher deductible leads to lower premiums.

Conclusion

Understanding the difference between health insurance deductible and premium is crucial for making informed decisions. The deductible is the amount you pay out of pocket before your insurance kicks in, while the premium is the monthly cost to maintain your coverage.

It’s important to strike a balance that suits your healthcare needs and financial situation.