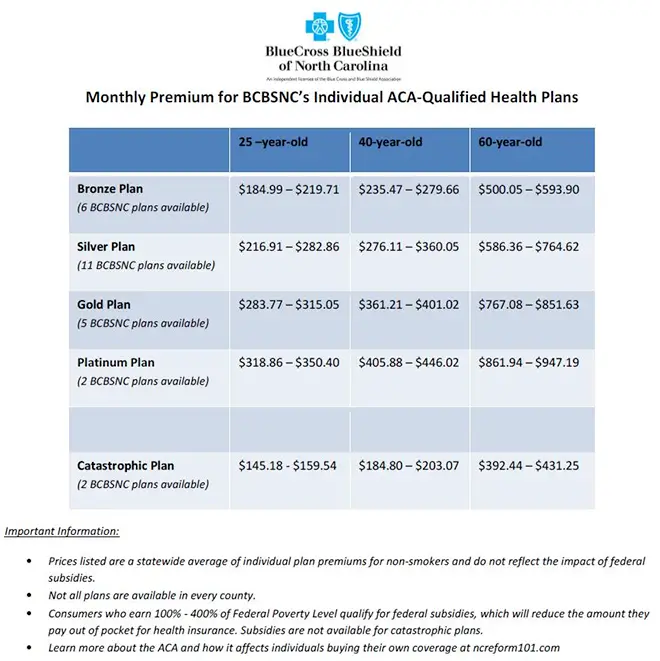

Health insurance costs with Blue Cross can range from $200 to $800 per month. Factors such as age, location, and coverage level impact the premium.

Blue Cross offers various plans tailored to individual needs, ensuring access to quality healthcare services. The monthly cost varies depending on the plan chosen and the number of individuals covered. It is essential to compare different options to find the most suitable and affordable health insurance plan.

Blue Cross provides comprehensive coverage and peace of mind for individuals and families seeking reliable healthcare protection. By understanding the costs and benefits of each plan, individuals can make informed decisions to safeguard their health and financial well-being.

Introduction To Health Insurance Costs

Exploring Health Insurance Costs: Unveiling the monthly premiums for Blue Cross in Austin, Texas. Discovering the expenses of health coverage for individuals and families to ensure comprehensive care.

Health insurance is a crucial aspect of financial planning, offering protection against unexpected medical expenses. The cost of health insurance can vary significantly based on several factors, including age, location, plan type, and individual health conditions. Understanding the key determinants of health insurance premiums is essential for making informed decisions when selecting a suitable plan.

Factors Influencing Health Insurance Premiums

Several factors influence the cost of health insurance premiums, with age being a significant determinant. Generally, older individuals tend to pay higher premiums due to an increased likelihood of requiring medical care. Additionally, the location of the insured individual plays a crucial role, as healthcare costs can vary widely across different regions. Other factors such as smoking status, pre-existing conditions, and the chosen plan’s coverage level also impact the premium amount.

Average Costs Across The Us

The average cost of health insurance across the United States can vary based on the type of plan and the specific coverage options included. On average, individuals can expect to pay between $150 to $400 per month for a basic individual health insurance plan. However, these costs can significantly fluctuate based on the factors mentioned earlier, as well as the provider and the specific benefits offered by the plan.

Credit: www.ibx.com

Blue Cross Blue Shield: A Closer Look

Discovering the cost of health insurance per month with Blue Cross Blue Shield can provide valuable insights. By understanding the premium payment options, individuals and families can make informed decisions about their healthcare coverage. Blue Cross Blue Shield of Texas offers a range of plans to suit various needs and budgets, ensuring access to quality care.

Blue Cross Blue Shield: A Closer Look When it comes to health insurance in the United States, Blue Cross Blue Shield is a well-known name. With a history that dates back to the early 20th century, Blue Cross Blue Shield has evolved into a nationwide network of independent health insurance providers. If you’re considering Blue Cross Blue Shield as your health insurance provider, it’s important to understand the history and evolution of the company, as well as the services and coverage options they offer.History And Evolution

Blue Cross Blue Shield was originally created in the early 1900s to provide coverage for hospital services. Blue Shield, a separate organization, was created to cover physicians’ services. Over time, the two organizations merged to become the Blue Cross Blue Shield Association, which is now made up of 36 independent health insurance providers across the United States.Services And Coverage Options

Blue Cross Blue Shield offers a range of health insurance plans for individuals, families, and businesses. Some of the services and coverage options available through Blue Cross Blue Shield include:- Preventive care, such as screenings and vaccinations

- Emergency services, including ambulance rides and emergency room visits

- Inpatient care, such as hospital stays

- Outpatient care, such as doctor visits and diagnostic tests

- Mental health and substance abuse treatment

- Prescription drug coverage

- Dental and vision coverage (depending on the plan)

Determining Health Insurance Costs

Determining health insurance costs with Blue Cross involves factors like age, location, and plan choice, affecting monthly premiums. Blue Cross offers various options tailored to individual needs, with costs typically ranging from $100 to $500 per month.

Role Of Age And Location

Determining health insurance costs involves considering various factors such as age and location. Age is a significant determinant, as younger individuals typically pay lower premiums compared to older individuals. Additionally, location plays a crucial role in determining health insurance costs, with premiums varying based on the cost of healthcare in the specific region.Impact Of Health Conditions

Health conditions also have a substantial impact on health insurance costs. Individuals with pre-existing conditions may face higher premiums due to the increased health risks associated with their condition. Insurance companies assess the health status of individuals to determine the level of risk and subsequently calculate the premium based on this assessment.Comparative Analysis Of Health Plans

When it comes to choosing a health insurance plan, it’s crucial to understand the differences between various options. Conducting a comparative analysis of health plans can help individuals and families make informed decisions that align with their specific healthcare needs and budget.

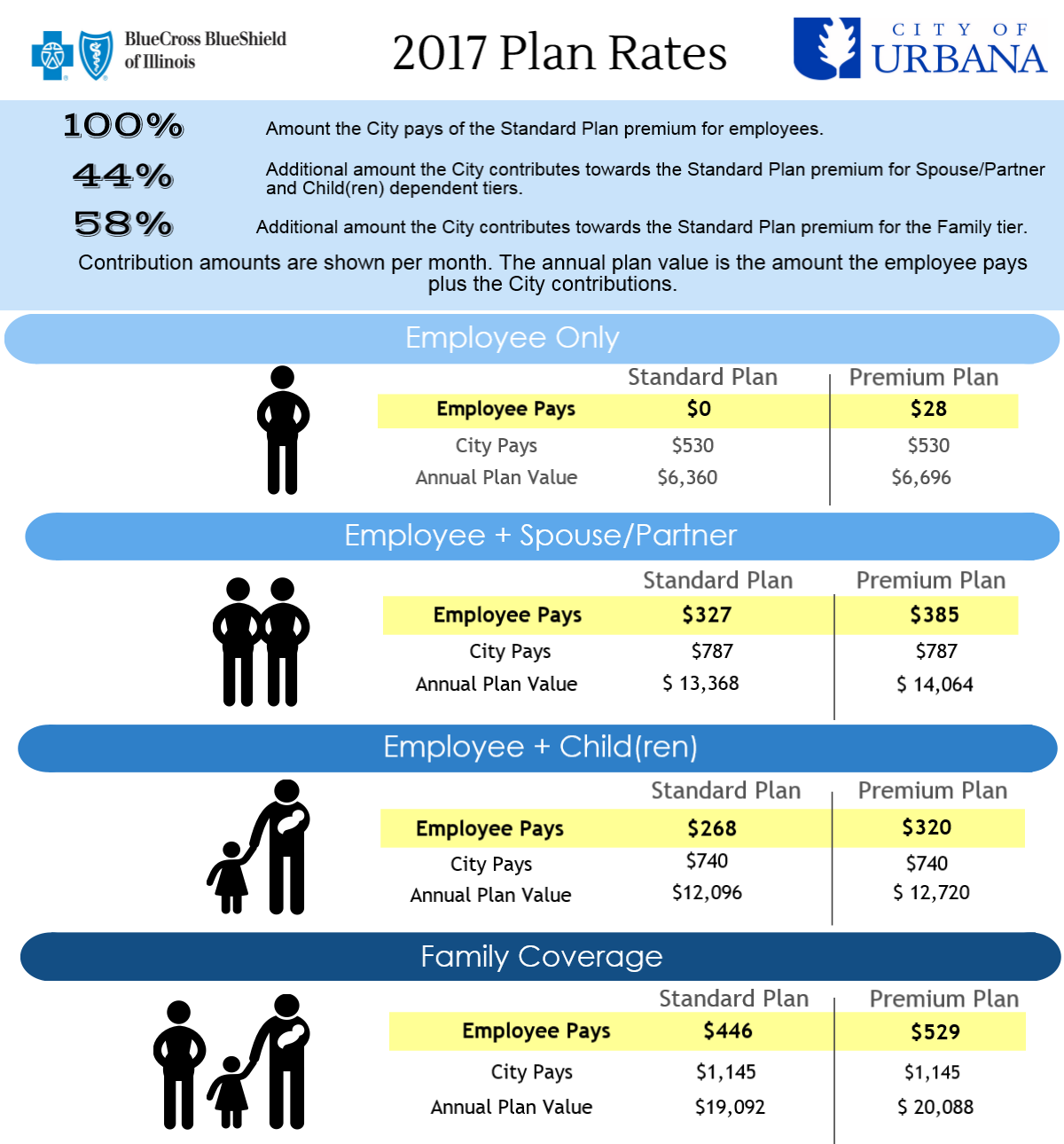

Individual Vs Family Plans

Individual health insurance plans are designed to cover the medical expenses of a single person, while family plans extend coverage to include dependents such as a spouse and children. When evaluating individual versus family plans, it’s essential to consider factors such as premium costs, deductibles, and out-of-pocket expenses.

High Deductible Vs Low Deductible Plans

High deductible health plans typically offer lower monthly premiums but require individuals to pay more out-of-pocket for medical expenses before the insurance coverage kicks in. On the other hand, low deductible plans involve higher monthly premiums but lower out-of-pocket costs when seeking medical care. Understanding the trade-offs between high and low deductible plans is essential for selecting the most suitable option based on individual financial circumstances and healthcare needs.

State Specifics: Focus On Texas

In Texas, the cost of health insurance per month with Blue Cross Blue Shield varies based on factors like age, location, and plan choice. Premiums can range from around $300 to $700 for an individual. It’s recommended to explore different options to find the best fit for your needs.

Health Insurance Environment In Texas

When it comes to health insurance in Texas, the landscape is influenced by a variety of factors, including the state’s demographic makeup, healthcare infrastructure, and regulatory environment. The Lone Star State boasts a diverse and dynamic health insurance market, with a range of options available for individuals and families.

Health insurance in Texas is regulated by the Texas Department of Insurance, which oversees the state’s insurance marketplace and ensures compliance with state laws and regulations. The department plays a crucial role in safeguarding consumer interests and promoting transparency within the insurance industry.

Popular Plans And Providers

Texans have access to a wide array of health insurance plans and providers, offering flexibility and choice to meet diverse healthcare needs. Blue Cross and Blue Shield of Texas (BCBSTX) is a prominent player in the state’s health insurance market, providing a range of coverage options tailored to the needs of Texans.

Other popular health insurance providers in Texas include Aetna, Cigna, UnitedHealthcare, and Humana, each offering a variety of plans designed to cater to different budgetary and healthcare requirements.

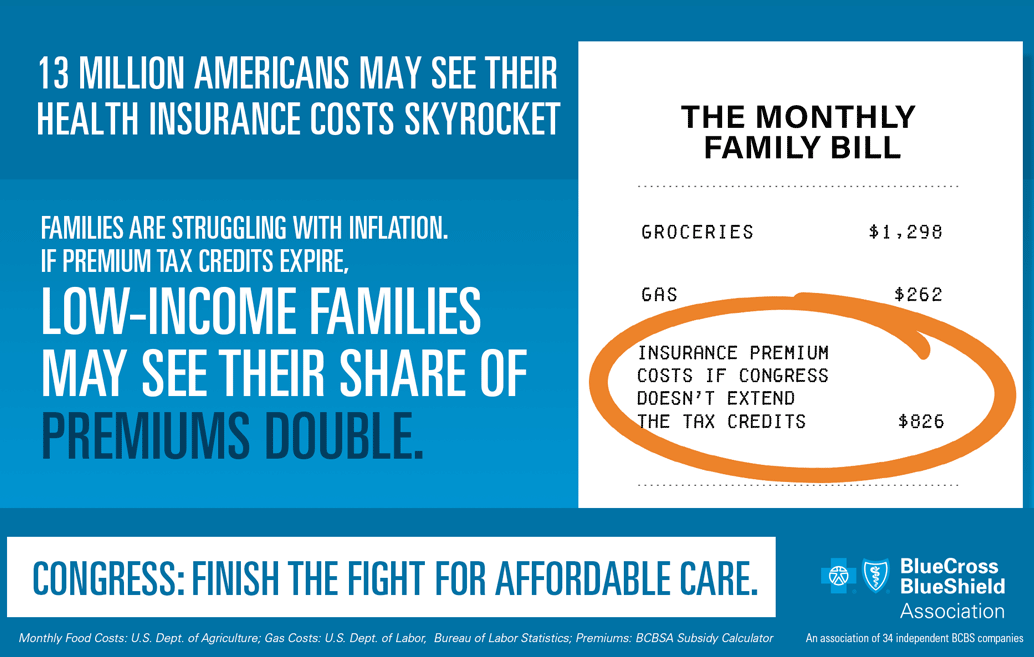

Financial Assistance And Subsidies

Discover how to obtain financial assistance and subsidies for health insurance costs with Blue Cross. Use the Subsidy Calculator to determine the amount of financial support available to reduce your monthly premiums. With Blue Cross, you can find affordable health insurance options to ensure the well-being of you and your family.

Qualifying for Government Assistance To qualify for government assistance, you need to meet specific income criteria. Calculating Your Potential Savings Calculate your potential savings based on your income and family size.Qualifying For Government Assistance

To qualify for government assistance, you must meet income requirements. – Income criteria varies based on family size and location. – Eligibility is determined by the federal poverty level guidelines. – Medicaid and CHIP are government programs that provide assistance.Calculating Your Potential Savings

Calculate potential savings using available subsidy calculators. – Subsidies are based on your income and family size. – Subsidies can significantly lower your monthly premiums. – Estimate your savings before choosing a health insurance plan.Consumer Reviews And Ratings

Discover the true cost of health insurance per month with Blue Cross through authentic consumer reviews and ratings. Understand the monthly premiums for individual and family plans, ensuring transparency and informed decision-making for your healthcare needs.

Consumer Reviews and Ratings When shopping for health insurance, it’s important to consider not only the cost but also the quality of the coverage provided. One way to assess the quality of a health insurance provider is to look at consumer reviews and ratings. Customer Satisfaction in Texas In Texas, Blue Cross Blue Shield is a popular health insurance provider. According to a survey conducted by the Texas Department of Insurance, Blue Cross Blue Shield of Texas received an overall customer satisfaction rating of 4 out of 5 stars. The survey also found that Blue Cross Blue Shield of Texas had a lower complaint ratio than the average for all health insurance providers in the state. Comparing Insurers: Blue Cross vs Others When comparing health insurance providers, it’s important to consider factors such as cost, coverage, and customer satisfaction. Blue Cross Blue Shield of Texas offers a range of health insurance plans to meet the needs of individuals and families. Other health insurance providers in Texas include Aetna, Cigna, and UnitedHealthcare. To help you compare health insurance providers, here’s a table summarizing some key features of Blue Cross Blue Shield of Texas and other top providers in the state: | Provider | Monthly Premium | Deductible | Customer Satisfaction Rating | |———-|—————-|————|——————————| | Blue Cross Blue Shield of Texas | $350 | $1,500 | 4/5 stars | | Aetna | $400 | $1,000 | 3/5 stars | | Cigna | $375 | $2,000 | 3.5/5 stars | | UnitedHealthcare | $425 | $2,500 | 3/5 stars | As you can see, Blue Cross Blue Shield of Texas offers competitive pricing and a high customer satisfaction rating compared to other top health insurance providers in the state. However, it’s important to consider your specific healthcare needs and budget when choosing a health insurance provider. In conclusion, when shopping for health insurance, it’s important to consider not only the cost but also the quality of the coverage provided. By looking at consumer reviews and ratings, you can get a better sense of the level of customer satisfaction with a particular health insurance provider.

Credit: www.bcbs.com

Future Trends In Health Insurance Costs

Explore the future trends in health insurance costs with Blue Cross and Blue Shield. Discover the monthly premium you can expect to pay for individual and family coverage, ensuring your well-being without compromising on quality care. Understand the variations in costs and make an informed decision for your healthcare needs.

Predicting Changes Post-pandemic

The future trends in health insurance costs are expected to be influenced by the aftermath of the pandemic. As the healthcare landscape continues to evolve, the impact of the pandemic on healthcare utilization, treatment costs, and insurance claims will play a significant role in shaping the trajectory of health insurance expenses. It is crucial for insurers to anticipate and adapt to the changing dynamics of healthcare post-pandemic to ensure sustainable and affordable coverage options for individuals and families.

Technological Impact On Insurance Pricing

Advancements in technology are poised to revolutionize the insurance industry and have a direct impact on pricing strategies. From data analytics and artificial intelligence to telemedicine and wearable devices, technology is reshaping the way insurers assess risk, manage claims, and personalize coverage. This technological evolution is likely to introduce new pricing models, enhance preventive care initiatives, and streamline administrative processes, ultimately influencing the overall cost of health insurance.

Credit: www.urbanaillinois.us

Frequently Asked Questions

How Much Is Health Insurance A Month For A Single Person In Us?

The cost of health insurance per month for a single person in the US varies depending on various factors such as age, location, and plan coverage. On average, a single person can expect to pay around $452 per month for a mid-level plan.

However, costs can range from as low as $200 to as high as $800 per month. It’s best to shop around and compare plans to find the best fit for your needs and budget.

Is $200 A Month Good For Health Insurance?

$200 a month for health insurance can be good depending on coverage and individual needs.

What Is Difference Between Blue Cross And Blue Shield?

Blue Cross and Blue Shield developed separately, with Blue Cross providing hospital coverage and Blue Shield covering physician services. Blue Cross is used by health insurance plans across the United States.

Is Blue Cross Blue Shield Texas Good?

Blue Cross Blue Shield Texas offers a range of health insurance plans. It’s well-regarded for its coverage and network of providers.

Conclusion

Understanding the cost of health insurance is essential for making informed decisions. Blue Cross offers a range of plans with varying premiums and coverage options. By comparing plans and considering individual needs, it’s possible to find affordable health insurance that meets specific requirements.

Researching and understanding the available options is crucial for securing the right coverage.