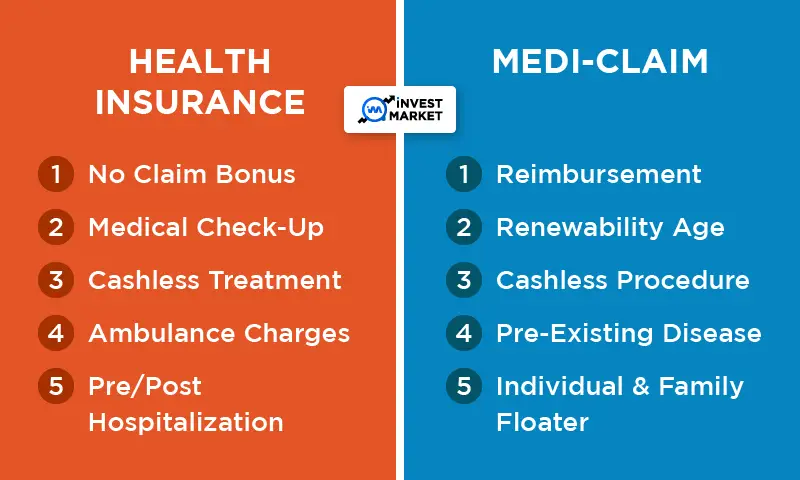

Health insurance covers comprehensive medical costs, while mediclaim only covers hospitalization expenses up to the sum insured. Health insurance provides broader coverage for medical and surgical expenses beyond hospitalization.

Understanding the difference between health insurance and mediclaim is crucial for choosing the right coverage to meet your healthcare needs. Health insurance offers a more extensive range of benefits and financial protection, making it a preferred choice for individuals seeking comprehensive healthcare coverage.

On the other hand, mediclaim is more limited in scope, focusing primarily on hospitalization-related expenses. By comparing the features and benefits of both health insurance and mediclaim policies, individuals can make informed decisions to safeguard their health and financial well-being.

Credit: www.etmoney.com

Introduction To Health Coverage

Health insurance and mediclaim serve as two distinct ways to cover medical expenses. While mediclaim specifically caters to hospitalization-related costs, health insurance offers broader coverage, including medical and surgical expenses beyond hospitalization. Understanding the differences between the two is essential for selecting the most suitable option to meet individual insurance needs.

Differentiating Health Insurance And Mediclaim

Health insurance provides comprehensive coverage for medical costs and surgical expenses beyond hospitalization. On the other hand, mediclaim covers only hospitalization-related expenses up to the sum insured.The Purpose Of Health Financial Products

Health insurance and mediclaim are vital financial products that help individuals manage their healthcare expenses effectively. While health insurance offers broader coverage, mediclaim specifically caters to hospitalization-related costs. In today’s uncertain times, having adequate health coverage is essential to protect oneself from unexpected medical bills. Health insurance and mediclaim play a crucial role in ensuring individuals have access to quality healthcare without worrying about the financial burden. When it comes to choosing between health insurance and mediclaim, it’s important to assess your individual needs and compare the benefits offered by each product. By understanding the differences between these health financial products, you can make an informed decision that best suits your healthcare requirements.

Credit: www.kotaklife.com

Decoding Mediclaim Policies

When it comes to health insurance, one of the most common types of policies people opt for is mediclaim. Mediclaim policies are designed to cover hospitalization expenses, but there are some key differences to be aware of when comparing them to traditional health insurance policies. Here, we’ll take a closer look at the scope and limitations of mediclaim policies.

Hospitalization Expenses

Mediclaim policies are specifically designed to cover hospitalization expenses, including room and board charges, doctor’s fees, and other related expenses. However, it’s important to note that mediclaim policies do not cover all medical expenses. For example, expenses related to outpatient care, diagnostic tests, and pre-existing conditions may not be covered under a mediclaim policy.

Scope And Limitations

While mediclaim policies are a popular choice for those looking to cover hospitalization expenses, they come with certain limitations. For instance, most mediclaim policies have a maximum coverage limit, which means that the policyholder may have to pay out-of-pocket for any expenses that exceed that limit. Additionally, some mediclaim policies may come with certain exclusions or waiting periods for pre-existing conditions.

It’s also worth noting that mediclaim policies are not as comprehensive as traditional health insurance policies. Health insurance policies typically offer broader coverage, including outpatient care, preventive services, and prescription drug coverage. If you’re looking for more comprehensive coverage, a traditional health insurance policy may be a better option.

When it comes to choosing between a mediclaim policy and a traditional health insurance policy, it’s important to carefully consider your needs and budget. While mediclaim policies can be a good option for those looking to cover hospitalization expenses, they do come with certain limitations. By understanding the scope and limitations of mediclaim policies, you can make an informed decision about which type of policy is right for you.

Understanding Health Insurance

Health insurance is a crucial tool in managing healthcare costs and ensuring financial security during medical emergencies. It provides coverage for a wide range of medical expenses, offering peace of mind and access to quality healthcare services.

Comprehensive Coverage

Health insurance offers comprehensive coverage for various medical expenses, including hospitalization, doctor’s consultations, diagnostic tests, medications, and surgical procedures. This ensures that individuals and their families are protected against a wide range of health-related expenses, promoting overall well-being and financial security.

Additional Benefits Beyond Hospitalization

Besides covering hospitalization expenses, health insurance also provides additional benefits such as outpatient treatments, maternity care, preventive healthcare services, and coverage for pre-existing conditions. These additional benefits enhance the scope of coverage, addressing diverse healthcare needs and promoting holistic well-being.

Credit: www.bajajfinservhealth.in

Financial Implications

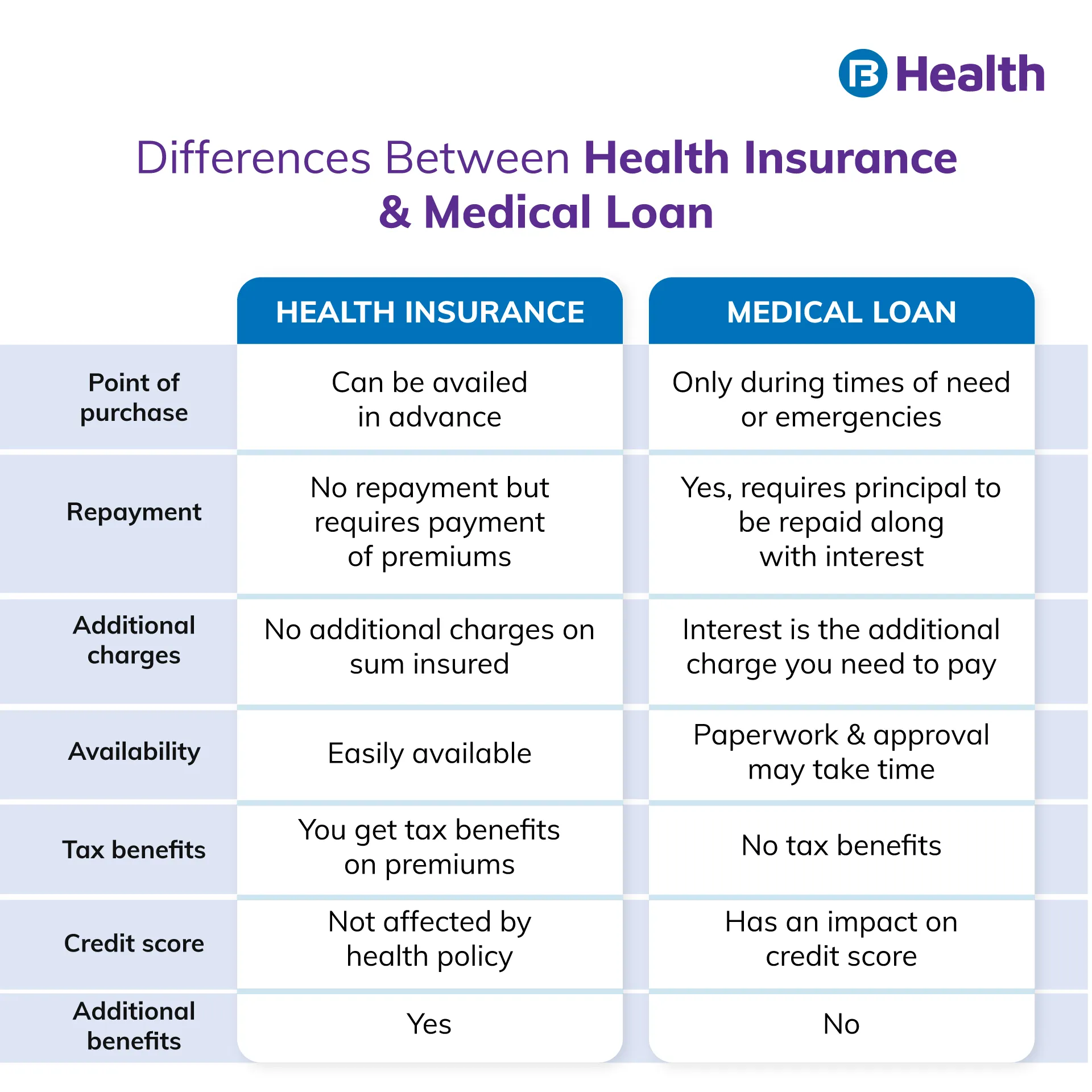

When it comes to safeguarding your health and finances, understanding the financial implications of health insurance and mediclaim is crucial. Let’s delve into the cost comparison and the nuances of premiums and sum assured to make an informed decision.

Cost Comparison

Health insurance and mediclaim differ significantly in terms of cost. While mediclaim covers only hospitalization expenses, health insurance offers comprehensive coverage, including pre and post-hospitalization costs, ambulance charges, and more. Therefore, health insurance tends to be relatively more expensive than mediclaim due to its extensive coverage.

Understanding Premiums And Sum Assured

When comparing health insurance and mediclaim, it’s essential to understand the premiums and sum assured. Health insurance typically involves higher premiums due to its broader coverage, ensuring financial protection against a wide range of medical expenses. On the other hand, mediclaim premiums are lower, but the sum assured is limited to hospitalization-related costs. Therefore, assess your healthcare needs and financial capabilities to make an informed decision.

Analyzing Coverage Details

When it comes to health insurance and mediclaim, understanding the coverage details is crucial. Analyzing the policy inclusions and exclusions, as well as comprehending the fine print, is essential to make an informed decision.

Policy Inclusions And Exclusions

Health insurance and mediclaim policies differ in their coverage details. While health insurance provides comprehensive coverage for various medical costs and surgical expenses, mediclaim is limited to hospitalization-related expenses up to the sum insured.

Understanding The Fine Print

It’s imperative to delve into the fine print of both health insurance and mediclaim policies. Pay close attention to the terms and conditions, limitations, and exclusions to ensure a clear understanding of what is covered and what is not.

Choosing The Right Plan

When it comes to safeguarding your health and financial well-being, choosing the right insurance plan is crucial. Understanding the differences between health insurance and mediclaim can help you make an informed decision that best suits your needs.

Assessing Your Insurance Needs

Before diving into the comparison of health insurance and mediclaim, it’s essential to assess your insurance needs. Consider factors such as your medical history, family medical history, current health status, and any specific medical requirements. This evaluation will help you determine the extent of coverage you require and the type of benefits that would be most beneficial for you and your family.

Comparing Plans

Once you have a clear understanding of your insurance needs, it’s time to compare the available plans. Look at the coverage offered by both health insurance and mediclaim policies. Assess the inclusions and exclusions, such as hospitalization expenses, pre-existing conditions coverage, outpatient services, and critical illness coverage. Additionally, compare the premium costs, co-payment requirements, and the network of hospitals and healthcare providers associated with each plan.

Claims And Reimbursements

Health Insurance and Mediclaim both offer coverage for medical expenses, but Health Insurance provides broader coverage beyond hospitalization. Mediclaim specifically focuses on hospital-related costs up to the insured sum. It’s important to evaluate your needs to choose the most suitable option for your health coverage.

Cashless Vs Reimbursement

One of the major differences between health insurance and mediclaim is the way claims are settled. Health insurance policies offer both cashless and reimbursement facilities. Cashless facility is when the policyholder can avail treatment at a network hospital without having to pay any money upfront. The insurance company settles the bill directly with the hospital. On the other hand, reimbursement facility is when the policyholder pays for the treatment upfront and later submits the bills to the insurance company for reimbursement.Network Hospitals And Their Impact

Network hospitals are a group of hospitals that have a tie-up with the insurance company. These hospitals offer cashless treatment facilities to policyholders. Health insurance policies have a wider network of hospitals as compared to mediclaim policies. This means that policyholders have the flexibility to choose from a larger pool of hospitals for treatment. However, in case of mediclaim policies, policyholders can only avail cashless treatment at a limited number of hospitals. This can be a disadvantage if the policyholder needs to get treated at a hospital that is not in the network. In conclusion, while both health insurance and mediclaim policies offer coverage for medical expenses, they differ in terms of the extent of coverage and the way claims are settled. When choosing between the two, it is important to assess your insurance requirements and compare the different plans to choose the right option.Expert Tips For Policy Buyers

Consulting With Professionals

Before making a decision, consult with insurance professionals to get expert advice.

Evaluating Policy Reviews And Ratings

Review and evaluate policy ratings to ensure you choose a reputable and reliable insurance provider.

Future Of Health Coverage

The future of health coverage lies in understanding the distinction between health insurance and mediclaim. Health insurance offers broader coverage for medical costs, while mediclaim specifically covers hospitalization expenses. It’s essential to assess your needs to determine the right option for comprehensive health coverage.

Emerging Trends In Health Insurance

As we look towards the future of health coverage, emerging trends in health insurance are shaping the way individuals protect their well-being. One notable trend is the rise of personalized health insurance plans tailored to individual needs and lifestyles. This customization allows for more comprehensive coverage and cost-effective solutions for policyholders.

Innovations In Mediclaim Policies

On the other hand, innovations in Mediclaim policies are revolutionizing the way medical expenses are covered. With advanced technologies and data analytics, Mediclaim policies are becoming more efficient in processing claims and providing quicker reimbursements to policyholders. Additionally, there is a growing focus on preventive healthcare services within Mediclaim policies to promote overall wellness.

Frequently Asked Questions

Is There A Difference Between Healthcare And Health Insurance?

Yes, healthcare is a service, while health insurance is a product and is optional. Healthcare is essential, but health insurance is not necessary to receive those services.

What Is The Difference Between Mediclaim?

Mediclaim covers hospitalization expenses up to a limit, while health insurance offers broader coverage beyond hospitalization costs.

What Are The Top 3 Health Insurances?

Top 3 health insurances are Blue Cross Blue Shield, Kaiser Permanente, and Oscar.

Which Type Of Health Insurance Is Most Expensive?

Platinum health insurance is the most expensive type of health insurance available. It offers low deductibles, out-of-pocket maximums, copays, and coinsurance in exchange for high monthly premiums. This plan is best suited for people with serious or chronic health concerns.

However, mediclaim only covers hospitalization-related expenses and is not as comprehensive as health insurance. It is important to assess your insurance requirements and compare plans to choose the right option.

Conclusion

It’s essential to carefully assess your insurance needs and compare different plans to make the right choice between health insurance and mediclaim. While health insurance provides comprehensive coverage, mediclaim caters only to hospitalization-related expenses. Understanding the differences will help you choose the most suitable option for your healthcare needs.