Health insurance can’t be canceled at any time, unlike auto insurance policies. Policyholders have the flexibility to cancel their auto insurance policy at any time, for any reason, without waiting until the end of the policy period.

This allows for greater control and autonomy over insurance coverage. However, canceling health insurance is subject to certain rules and regulations, particularly if it is employer-sponsored. Understanding the nuances of canceling health insurance is crucial for making informed decisions about coverage.

Let’s delve into the factors that influence the cancelation of health insurance policies and the options available to policyholders.

Health Insurance Cancellation Myths

Health insurance can be canceled despite the myth that it can’t be terminated. Policyholders have the right to cancel their health insurance at any time, for various reasons, without waiting until the end of the policy period. It is essential to understand the process and options available for canceling health insurance coverage.

Common Misconceptions

There are many myths surrounding health insurance cancellation that can cause confusion for policyholders. One common misconception is that health insurance can be canceled at any time for any reason. Another myth is that insurance companies cannot cancel a policy once it has been issued. It’s important to understand the reality of policy termination to avoid any surprises or misunderstandings.Reality Of Policy Termination

In reality, health insurance policies cannot be canceled at any time without cause. Insurance companies must have a valid reason to cancel a policy, such as non-payment of premiums or fraud. Additionally, policyholders have the right to appeal any cancellation decision made by their insurance company. It’s important to note that cancelable policies may be terminated by the insurer, but non-cancelable policies cannot be canceled by either party. To avoid any misunderstandings, it’s important to carefully review your health insurance policy before signing up. Make sure you understand the terms and conditions of your policy, including any cancellation policies. If you have any questions or concerns, don’t hesitate to contact your insurance company for clarification. In summary, health insurance cancellation myths can cause confusion and misunderstanding for policyholders. It’s important to understand the reality of policy termination to avoid any surprises or misunderstandings. Remember to carefully review your health insurance policy and contact your insurance company if you have any questions or concerns.Cancellation Policies Explained

When it comes to health insurance, understanding the cancellation policies is crucial. Whether it’s a voluntary or involuntary termination, or if there are any restrictions imposed by the insurance company, knowing the ins and outs of cancellation policies can save you from any potential surprises.

Voluntary Vs. Involuntary Termination

Voluntary termination refers to the policyholder’s decision to cancel their health insurance coverage. This could be due to various reasons such as obtaining coverage through another source, financial constraints, or simply not needing the coverage anymore. On the other hand, involuntary termination occurs when the insurance company decides to cancel the policy, often due to non-payment of premiums or fraudulent activities. It’s important to be aware of the terms and conditions regarding both voluntary and involuntary termination in your health insurance policy.

Insurance Company Restrictions

Insurance companies may impose certain restrictions on the cancellation of health insurance policies. These restrictions could include specific time frames within which a policy can be canceled, requirements for providing a valid reason for cancellation, or limitations on canceling the policy outside of the open enrollment period. It’s essential to thoroughly review the terms and conditions of your health insurance policy to understand any restrictions imposed by the insurance company.

Your Rights During Cancellation

When it comes to health insurance cancellation, it’s crucial to understand your rights and the protections in place.

Legal Protections For Consumers

As a consumer, you are entitled to certain legal protections when it comes to the cancellation of your health insurance policy. Insurance companies must adhere to specific guidelines and regulations to ensure that your rights are protected.

Insurance Company Obligations

Insurance companies have obligations to policyholders during the cancellation process. They are required to provide clear and timely communication regarding the cancellation, including the reasons for it. Additionally, they must offer alternative coverage options and assist with the transition to a new plan if needed.

Credit: www.policygenius.com

Cancellation Triggers

When it comes to health insurance, understanding the circumstances under which a policy can be canceled is crucial. There are specific triggers that can lead to the cancellation of a health insurance policy, and it’s important to be aware of these to avoid any unexpected disruptions in coverage. Let’s take a look at the different cancellation triggers that can impact your health insurance policy.

Qualifying Life Events

Qualifying Life Events are situations such as marriage, divorce, birth or adoption of a child, or loss of other health coverage that may allow you to make changes to your health insurance outside of the open enrollment period. These events trigger a special enrollment period, during which you can make changes to your health insurance coverage, including canceling your current policy.

End Of Contract Scenarios

End of Contract Scenarios refer to situations where the contract between the policyholder and the insurance provider reaches its termination date. At the end of the contract period, the policyholder may have the option to renew the policy or choose a different plan. However, if the contract is not renewed or replaced with a new policy, it may lead to the cancellation of the existing health insurance coverage.

Employer-sponsored Insurance

Employer-sponsored insurance, also known as group health insurance, is a type of health coverage provided by an employer to its employees. This type of insurance is an essential benefit for many workers and their families, offering a range of health benefits and financial protection.

Cancellation Limitations

Under employer-sponsored insurance, the cancellation of a health insurance policy is subject to specific limitations. Unlike individual health insurance plans, which can often be canceled at any time, group health insurance policies typically cannot be canceled by the insured individual outside of the company’s open enrollment period.

Special Enrollment Periods

When it comes to employer-sponsored insurance, individuals may only cancel their policy outside of the open enrollment period if they experience a qualifying life event. These events could include marriage, the birth of a child, or the loss of coverage from another source. In such cases, the individual may trigger a special enrollment period, allowing them to make changes to their health coverage.

Navigating Marketplace Plans

How To Terminate Coverage

Policyholders can cancel their health insurance plan at any time by following these steps:

- Contact your insurance provider directly.

- Request to cancel your policy.

- Provide any necessary information or documentation.

- Confirm the cancellation in writing for your records.

Impact Of Cancellation On Eligibility

Terminating your health insurance coverage may have the following effects on your eligibility:

- Loss of coverage benefits and protections.

- Potential gaps in healthcare coverage.

- Requirement to find alternative coverage options.

- Eligibility for special enrollment periods under certain circumstances.

Preventing Unjust Cancellations

To prevent unjust cancellations, health insurance policies cannot be canceled without reason or notice. Insured individuals have the right to terminate a cancelable policy at any time, with insurers required to provide proper notification and refund any prepaid premiums accordingly.

Crackdown On Frivolous Practices

Preventing unjust cancellations of health insurance policies is a crucial step in ensuring that individuals have access to continuous coverage. To achieve this, regulatory bodies and policymakers are cracking down on frivolous practices that lead to unjust cancellations.

What Constitutes Misinformation

It’s important to understand what constitutes misinformation in the context of health insurance cancellations. Misleading policyholders about their rights, coverage details, or premium payments can lead to unjust cancellations and is considered misinformation. Clear communication and transparency are essential to prevent such occurrences.

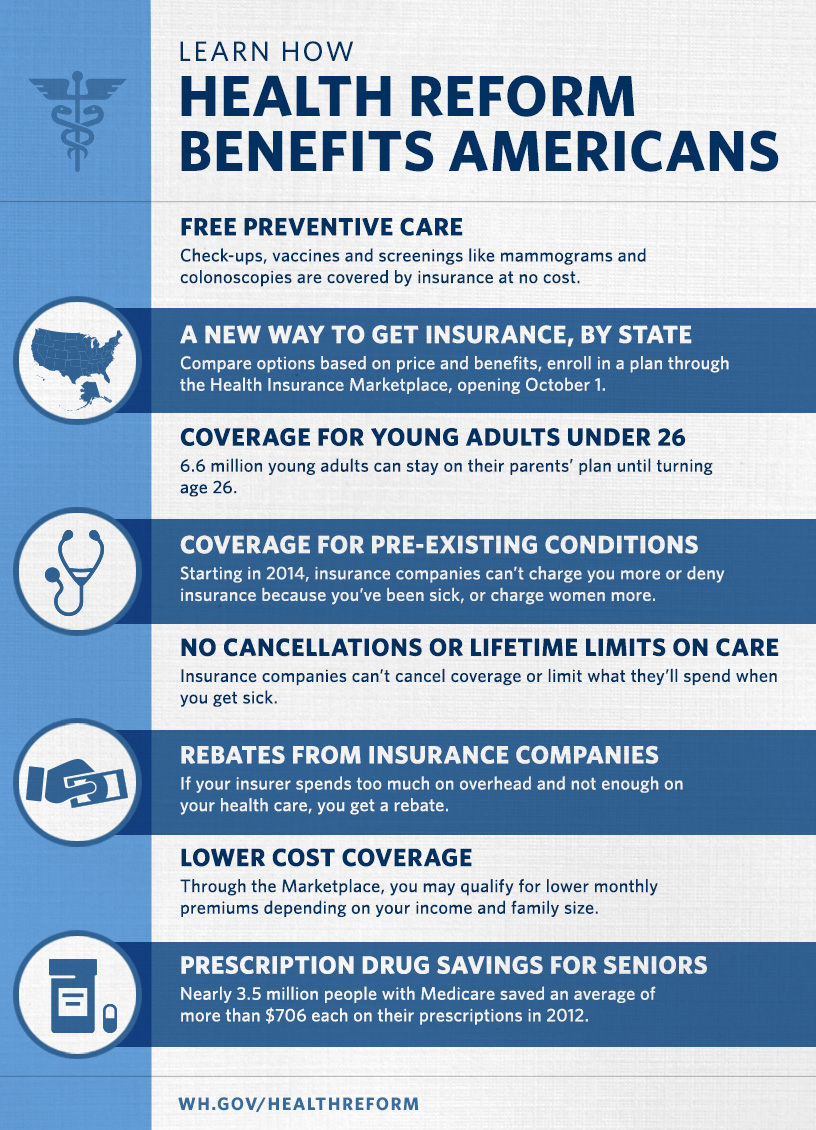

Credit: obamacarefacts.com

Appealing Cancellation Decisions

Appealing cancellation decisions are crucial when it comes to health insurance, which cannot be canceled arbitrarily. Policyholders must understand their rights and options for canceling or changing their coverage, ensuring they are well-informed about the process. It is essential to adhere to the terms and conditions to avoid any issues with coverage cancellation.

Understanding Your Appeal Rights

If your health insurance has been canceled, you may feel like you have no options left. However, it’s important to understand that you have the right to appeal the decision. The first step is to carefully review your policy to determine if the cancellation was justified. If you believe that the cancellation was unfair or improper, you have the right to appeal the decision.The Appeal Process

The appeal process for health insurance cancellations can be complex, but it’s important to follow the steps carefully. The first step is to contact your insurance provider and request an appeal. This can typically be done either over the phone or in writing. Once you’ve made your request, the insurance company will review your case and make a decision. If your appeal is denied, you may be able to take your case to an independent review organization. This organization will review your case and make a decision based on the evidence presented. If you are still not satisfied with the decision, you may be able to take your case to court. In conclusion, if your health insurance has been canceled, it’s important to understand your appeal rights. You have the right to appeal the decision if you believe it was unfair or improper. The appeal process can be complex, but it’s important to follow the steps carefully. If you’re not satisfied with the decision, you may be able to take your case to an independent review organization or court.

Credit: digitalcollections.nypl.org

Frequently Asked Questions

Can I Cancel My Insurance Policy At Any Time?

You can cancel your insurance policy at any time, for any reason, without waiting.

Can Health Insurance Be Cancelled Mid Year?

Health insurance can be canceled mid-year by the insured, but not by the insurer.

Who May Terminate Coverage Under A Cancelable Health Insurance Policy?

The insured can terminate coverage under a cancelable health insurance policy at any time.

Can You Cancel United Health Insurance At Any Time?

Yes, you can cancel your United Health insurance at any time. However, if you have group health insurance through your employer, you may only be able to cancel during open enrollment or if you experience a qualifying life event. For individual policies, you can cancel at any time.

Conclusion

Understanding the process of canceling health insurance is crucial for policyholders. Knowing your rights and options can help you make informed decisions regarding your coverage. Remember, being well-informed ensures you are in control of your health insurance choices. Stay informed, stay protected.