Health insurance protects you from unexpected, high medical costs and provides coverage for preventive care. It reduces the financial burden and offers monetary reimbursement during crises, while also aiding in reducing mental stress.

Health insurance is a vital aspect of personal and financial well-being, offering protection and peace of mind. Health insurance benefits are essential for individuals and families, providing access to healthcare services and financial protection against high medical expenses. It covers preventive services such as wellness visits, shots, and screening tests, contributing to overall well-being.

Moreover, it eases the burden of medical costs and reduces stress and anxiety related to healthcare expenses, ultimately leading to higher morale and job satisfaction. Overall, health insurance plays a crucial role in safeguarding both physical and financial health.

The Importance Of Health Insurance

Health insurance is crucial for individuals and families to safeguard their well-being and financial stability.

Financial Protection From Medical Costs

Health insurance shields you from unforeseen and high medical expenses, reducing the financial burden significantly.

Access To Preventive Care Services

With health insurance, you have access to free preventive care such as vaccines, screenings, and check-ups, promoting early detection and overall well-being.

Credit: www.fiercehealthcare.com

Understanding Health Insurance Coverage

Understanding Health Insurance Coverage is crucial for ensuring access to essential healthcare benefits. Health insurance provides financial protection and access to a range of medical services, offering peace of mind and security in times of need. Let’s explore the essential components of health insurance coverage and how it enhances healthcare access.

Essential Health Benefits Explained

Health insurance plans are designed to cover essential health benefits that are vital for maintaining overall well-being. These benefits typically include:

- Hospitalization and emergency services

- Prescription drugs

- Mental health and substance abuse treatment

- Preventive and wellness services

- Pediatric services, including dental and vision care for children

How Coverage Enhances Healthcare Access

Health insurance coverage plays a pivotal role in improving healthcare access for individuals and families. It facilitates:

- Regular access to preventive care, such as vaccinations and screenings, promoting early detection of health issues.

- Reduced financial burden by covering a significant portion of medical expenses, ensuring affordability of essential treatments.

- Enhanced mental well-being by alleviating stress associated with medical costs and providing financial security during health crises. “`

The Impact Of Health Insurance On Wellness

Health insurance benefits play a crucial role in promoting wellness by providing financial protection and access to necessary medical care. This coverage reduces the burden of high healthcare costs, ensuring individuals can prioritize their health without added stress.

Preventive Care And Regular Screenings

Health insurance provides coverage for preventive care and regular screenings that can help detect and prevent health problems before they become serious. This includes routine check-ups, blood tests, cancer screenings, and vaccinations. By having access to these services, individuals can take proactive measures to maintain their health and prevent the onset of chronic diseases.Vaccines And Check-ups

Vaccines are an important part of preventive care, and health insurance can provide coverage for a range of vaccines, including those for flu, pneumonia, and HPV. Regular check-ups are also essential for maintaining good health, as they allow doctors to identify any potential health problems early on. With health insurance, individuals can have access to these essential services without having to worry about the cost. Overall, the impact of health insurance on wellness cannot be overstated. By providing coverage for preventive care, regular screenings, vaccines, and check-ups, health insurance can help individuals maintain good health and prevent the onset of chronic diseases. It’s essential to have health insurance coverage to ensure that you’re covered in case of unexpected medical expenses and to have access to preventive care services that can help you stay healthy.Financial Aspects Of Health Insurance

Health insurance offers substantial benefits by reducing out-of-pocket expenses for medical care. By having health insurance coverage, individuals can access in-network healthcare services at lower costs, even before reaching their deductible. This helps in minimizing the financial burden of medical treatments and encourages people to seek necessary healthcare without worrying about exorbitant expenses.

One of the significant financial aspects of health insurance is the provision of monetary reimbursement during crises. In unforeseen circumstances, when individuals face medical emergencies, health insurance provides financial support to cover the incurred expenses. This not only safeguards individuals from the financial strain but also alleviates the mental stress associated with managing healthcare costs during such challenging times.

Health Insurance As An Employee Benefit

Health insurance is a vital employee benefit that plays a crucial role in the overall well-being of the workforce. Providing access to quality healthcare coverage demonstrates a company’s commitment to the health and financial security of its employees. This offering not only attracts top talent but also enhances employee retention and satisfaction.

Job Satisfaction And Employee Morale

Access to health insurance significantly impacts job satisfaction and employee morale. When employees feel supported through comprehensive health coverage, they are more likely to feel valued and satisfied in their roles. This can lead to increased productivity and a more positive work environment.

Healthcare Costs And Financial Burden

Health insurance helps alleviate the financial burden associated with healthcare costs. It provides employees with a sense of financial security and reduces the anxiety related to medical expenses. This, in turn, results in improved financial well-being and reduced stress levels among employees.

Credit: www.mass.gov

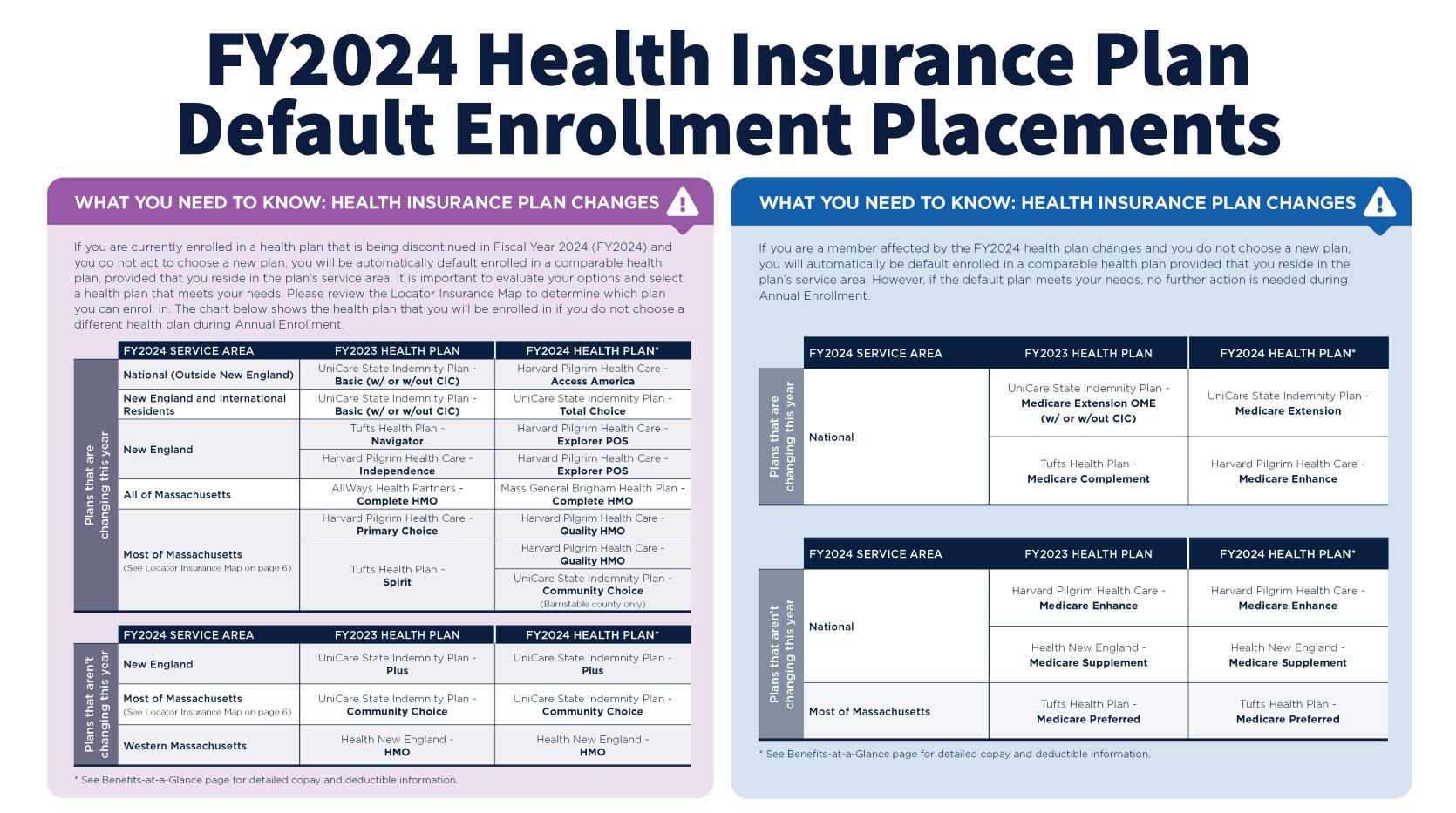

Comparing Health Benefit Plans

Comparing health benefit plans can help you find the most suitable coverage for your needs. Health insurance benefits provide financial protection and access to essential healthcare services to safeguard your well-being. Understanding the differences between plans ensures you choose the best option for you and your family.

Evaluating Coverage Options

When it comes to choosing a health insurance plan, it can be overwhelming to navigate the various options available. One important step is to evaluate the coverage options of each plan to ensure it aligns with your healthcare needs. To start, consider the type of plan being offered, such as a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO). HMOs typically have lower out-of-pocket costs but require you to use providers within their network, while PPOs offer more flexibility but may come with higher costs. Next, review the plan’s benefits, including preventive care coverage, prescription drug coverage, and mental health services. It’s important to understand the deductibles, copays, and coinsurance for each benefit to determine the potential out-of-pocket costs. Finally, evaluate the plan’s network of healthcare providers to ensure there are options in your area and that your current providers are included.Texas Health Insurance Insights

In Texas, residents have access to a variety of health insurance options through the Health Insurance Marketplace or through private insurance companies. Texas also offers a Medicaid program for eligible low-income individuals and families. When comparing health insurance plans in Texas, it’s important to consider the unique healthcare needs of you and your family. Texas has a diverse population with varying healthcare needs, so be sure to evaluate the coverage options and provider networks available to ensure you receive the necessary care. Overall, taking the time to compare health benefit plans can help you find a plan that aligns with your healthcare needs and budget. Consider evaluating the coverage options and provider networks of each plan to make an informed decision.The Psychological Benefits Of Being Insured

Health insurance provides not only physical protection but also significant psychological benefits. Being insured can alleviate mental stress and promote peace of mind, contributing to overall well-being.

Mental Stress Mitigation

Health insurance plays a crucial role in mitigating mental stress. Knowing that you have access to necessary medical care without the fear of financial burden can relieve anxiety and worry. This assurance can positively impact mental health and reduce stress-related ailments.

Peace Of Mind

Having health insurance provides a sense of peace of mind. It allows individuals to feel secure and protected, knowing that they are covered in the event of an unexpected health issue. This assurance can contribute to a more positive outlook on life and enhance overall mental well-being.

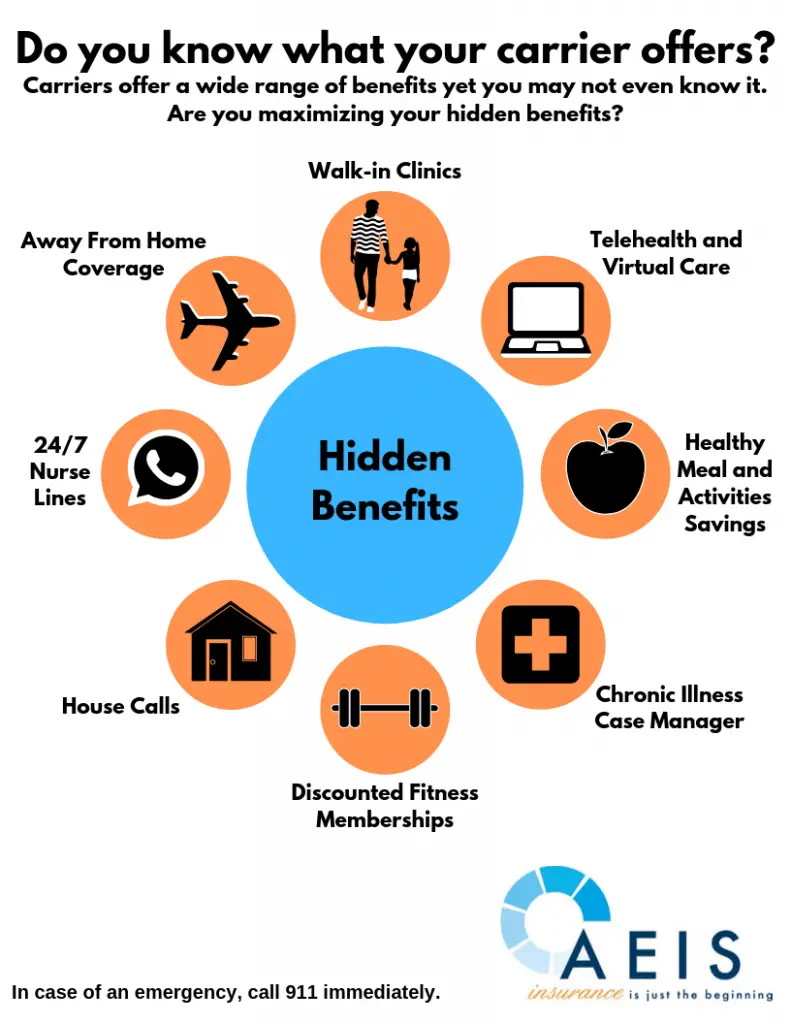

Navigating Insurance Plans And Services

Understanding your health insurance policy is crucial for maximizing its benefits. When it comes to selecting the right plan for you, there are several key factors to consider.

Understanding Your Policy

- Review your policy documents carefully to understand coverage details.

- Note the services that are included and excluded from your plan.

- Understand the co-pays, deductibles, and out-of-pocket maximums.

- Familiarize yourself with the network of providers covered by your plan.

Selecting The Right Plan For You

- Compare different plans based on your healthcare needs and budget.

- Consider factors such as premiums, deductibles, and coverage limits.

- Evaluate the network of doctors and hospitals included in each plan.

- Seek guidance from insurance representatives or brokers if needed.

By taking the time to understand your policy and selecting the right plan, you can ensure that you make the most of your health insurance benefits.

Credit: www.researchgate.net

Frequently Asked Questions

What Are The Benefits Of Your Health Insurance?

Health insurance provides protection from high medical costs and offers free preventive care like vaccines and screenings. It reduces financial burden and provides peace of mind during medical crises.

What Are The 10 Essential Health Benefits?

The 10 essential health benefits include preventive services, outpatient care, emergency services, hospitalization, maternity and newborn care, mental health and substance abuse services, prescription drugs, rehabilitative services, laboratory services, and pediatric services. These benefits are crucial for maintaining overall health and well-being.

What Are The Benefits Of Insurance Policy?

Insurance policies provide financial protection and reimbursement during crises, reducing the impact of losses and offering peace of mind.

Why Is Health Insurance A Good Employee Benefit?

Health insurance is a valuable employee benefit as it provides financial protection, reduces stress, and boosts morale.

Conclusion

Health insurance benefits provide financial security and peace of mind in times of need. They cover medical costs, offer preventive care, and reduce stress. By ensuring access to quality healthcare, insurance benefits contribute to overall well-being and job satisfaction. Choose insurance for a healthier future.